Scottish Suckler Beef Support Scheme (Mainland and Islands) full guidance

Date published: 26 July, 2018

For recent changes to this guidance, please see the bottom of the page.

Table of Contents

- Introduction

- Claiming subsidy

- Claim period

- Eligibility

- Economic Responsibility

- Withdrawals

- Force majeure / exceptional circumstances

- Eligibility checks

- Cattle keeping requirements

- Inspections

- Penalties

- Declarations and undertakings

- Payments

- Our targets

- Information about you and your payments

- Appeals and complaints

- Legal base

- Annex A – non-eligible breeds

- Annex B – single sheet passport example

- Annex C – written list of animals to claim

- Recent changes

- Previous versions

- Download guidance

Introduction

These notes cover the Scottish Suckler Beef Support Scheme (Mainland and Islands). Please read them carefully so you understand the rules of the scheme.

If you have any questions or concerns, please get in touch with your local area office.

Overview of scheme

- this scheme gives direct support to specialist beef producers. It has an annual budget of €38 million for Scottish mainland claims and €6.6 million for claims from the Scottish islands. Payments in sterling will depend on the exchange rate in force at the time

- the scheme year runs from 1 January to 31 December

- we pay on male and female calves at least 75 per cent beef bred

- calves must have been born on your Scottish holding and kept there for 30 days

- animals born on or after 2 December are not eligible until the next scheme year. We consider an animal to be one day old on the day after it was born. So an animal born on 2 December is not 30 days old until after 1 January

- claims can be made throughout the year and there is no limit to the number of claims you can make by the close of the scheme year on 31 December.

- you must keep a herd record book and officially identify cattle on your holding in line with the Cattle Identification Regulations (Scotland 2007)

- we set the payment rate to match the number of eligible animals claimed each scheme year

- we may inspect your holding to check you have met the scheme rules

Registering with Rural Payments and Services (RP&S)

To apply for this scheme, you must be registered on RP&S.

Claiming subsidy

Maximum number of claims

There is no limit to the number of claims you can make.

Claiming online

Using our online service is the easiest and quickest way to submit your claim. It helps stop mistakes and reduces the administration costs of the scheme.

Even if you have no access to the internet, you may be able to make use of computers in your local area office.

More information can be found in our customer services section.

Claiming offline

You can still claim by post using the:

Scottish Suckler Beef Support Scheme (Mainland and Islands) claim form

You can also access copies of the claim form from your local area office. Completed forms should be sent to your local area office. Details can be found in our Contact Us section

We will only accept and acknowledge your claim form if you or your agent has:

- filled in your Main Location Code, business name and address in section one

- filled in the numbers claimed box and location box(es) in section two

- signed and dated the form in section three. If your claim form has separate pages all must be signed and dated (this may be the case if you print it yourself)

- supplied ear-tag numbers (see supporting documents for paper claims below)

Supporting documents for paper claims

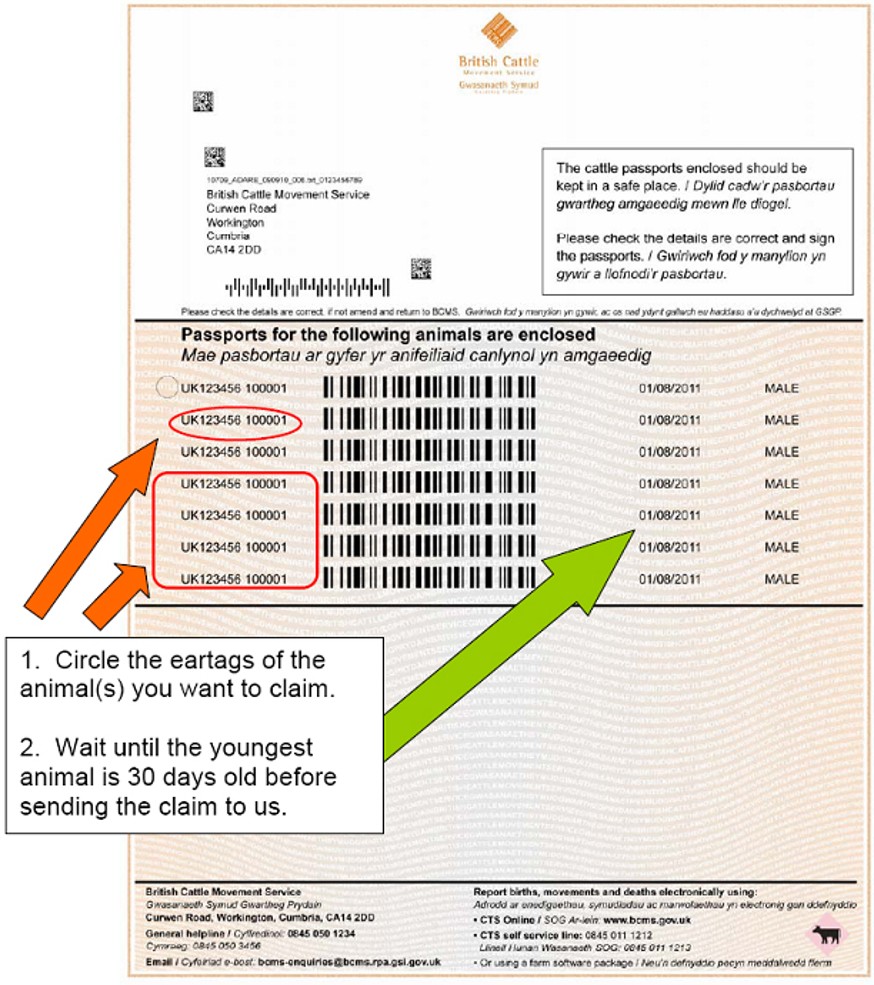

- use the address sheet issued with the single sheet passports from 1 August, 2011 to claim animals. We are unable to return this document to you. Annex B is an example of how to complete this

- you can provide a list of eartags from a farm management software program. Most programs can produce a list in barcode format which also helps us process your claim quickly and accurately

- if you can’t do any of the above we will accept a written list from you in the format shown in Annex C

The total number of single sheet passports, ear-tag numbers circled on address sheets, or eartags provided on an annex c list, must equal the total number of animals you are claiming for.

Remember to sign, date and write your Main Location Code on any list of ear tags you provide. Attach it securely to the claim form.

Claim period

Claims can be made throughout the year and there is no limit to the number of claims you can make by the close of the scheme year on 31 December.

Eligibility

Producers and agents

Individuals, companies, partnerships, or a group of these can all claim from this scheme.

You can give an agent authority to act for you and sign your claim form. If you use an agent, you must authorise them to act for you.

You can do this online by creating an account with Rural Payments and Services and logging in.

Alternatively, you can download and complete Form PF05 – Business Mandate You can also get this form from your local area office.

Holdings

Your holding is all the production units (farms or crofts) that you manage. Only production units in Scotland are eligible for this scheme.

Single Application Form

To claim for this scheme you must also complete a Single Application Form each year. If you do not do this, your claim will not be valid and we will not make a payment. The main location code you use on your claim form should be the same as the one on your Single Application Form.

Eligible animals

We pay on calves which:

- you own or lease

- are born on your Scottish holding and kept there continuously from birth for at least 30 days (animals which were too young to claim can be entered on a new application in a subsequent year)

- were born on or after 2 December, 2014

- have a valid cattle passport

- have not been paid under the previous schemes (Scottish Beef Calf Scheme or Scottish Beef Scheme)

- have been correctly officially identified

- are at least 75 per cent beef bred

Annex A lists breeds that are non-eligible.

Dual purpose breeds

Certain dual purpose cattle breeds which were previously regarded as ineligible for SSBSS have been deemed eligible to claim from the 2017 scheme year onwards.

The relevant breeds are:

- Fleckvieh

- Fleckvieh Cross

- Blue Albion

- Blue Albion Cross

- Swedish Red Polled

Animals from these breeds only became eligible once the governing legislation was amended so they could not be claimed prior to 2017.

Any animals from these breeds which have previously been claimed in 2015 or 2016 (which will have failed validation) can be submitted on new claims.

Claimed animals from dual-purpose breeds will only be deemed eligible if they are part of a suckler beef herd – therefore progeny of a cow being used for milk production will not be eligible.

If farmers who wish to claim the animals have both dairy and suckler herds then they will need to be able to demonstrate that the dam of the claimed animal is not part of the milking herd.

The requirement to be part of a suckler beef herd will apply to all other breeds recognised as dual purpose. Farmers who wish to claim these breeds from 2017 onwards will also have to demonstrate that the claimed animals have not been produced from the dairy herd.

The relevant breeds currently identified are:

- Montbeliarde

- Meuse Rhine Issel

Cross Compliance

To be eligible for this scheme you must keep your land in Good Agricultural and Environmental Condition (GAEC) and meet the legal requirements of keeping cattle as part of our Statutory Management Requirements (SMRs).

Find out more about Cross Compliance.

Economic Responsibility

Under the scheme, you must have economic responsibility for the animals which you include in your claim and be able to provide evidence of your ability to meet this requirement if required by RPID. Economic responsibility means that you must be responsible for:

- management of the herd

- feeding

- housing and paying the bills

- veterinary care

- ownership, including receipts from sales, of any progeny

- the selecting of animals brought into or disposed of from the herd

In essence, this means that you must own or have a formal leasing agreement on the animals

included in your claim. Economic responsibility does not include arrangements to buy animals and sell them back to the original owner, whether for a single or multiple scheme years and/or where the original owner undertakes day-to-day management of the herd. If you have some other arrangement which you think may entitle you to claim SSBSS, contact your SGRPID Area Office before you complete your claim form.

Withdrawals

You can write to us to withdraw an entire claim or individual animals at any time. But not if we have told you we will be inspecting your holding, or have told you about any errors in your claim.

Force majeure / exceptional circumstances

If you have been unable to comply with the rules of the scheme as a result of force majeure/exceptional circumstances, you may retain the right to aid in respect of the claimed animal numbers.

To qualify you must notify us in writing with relevant evidence within 15 working days from the date you are in a position to do so.

Eligibility checks

We will check by inspections and administrative checks that you have met the eligibility requirements detailed above. Where ineligible animals/claims are found your payment will be reduced in accordance with the scheme penalties outlined within this guidance.

We will check all the animals you claim with the Cattle Tracing System (CTS).

To check the CTS records for your animals, you can visit CTS Online.

Each eligible animal must only be claimed once. If you duplicate a claim for an animal in the same year or a subsequent year, we will treat this as an over-declaration and apply penalties.

You can avoid this by checking your claim record each and every time before you claim.

If an animal has failed validation as it was too young it can be entered again on a claim form in a subsequent year

Cattle keeping requirements

The Cattle Identification (Scotland) Regulations 2007, as amended, require cattle keepers to keep a herd register of all the animals on each of their County Parish Holding (CPH) locations for 10 years. These regulations also detail the rules on eartags.

Records and tagging must be accurate and up to date, or you may lose payments.

You can get further details on cattle identification and traceability rules from the British Cattle Movement Service (BCMS) website, by emailing them at bcmsenquiries@rpa.gov.uk or by calling their helpline on 0345 050 1234.

Inspections

We will inspect the cattle you claim under the scheme as part of our existing Cattle Identification Inspection programme.

We will check that you have met the scheme’s rules, as detailed in the relevant European Commission regulations and implemented and enforced by the Cattle Identification (Scotland) Regulations 2007, as amended.

Detailed guidance can be found in our Cattle identification inspections section.

You must allow us to inspect your records and animals at any reasonable date and time. We may ask you to gather your animals at a convenient place on the holding and you must provide secure handling facilities to allow us to check each animal’s ear tag.

We may not warn you about any inspection we plan to carry out and we may inspect your holding more than once a year.

We will not pay your subsidy and you could face prosecution if you:

- refuse to let us inspect your holding and animals

- prevent our inspector from coming onto your holding

- do not give reasonable help to the inspector

At an inspection we will check:

- By means of a physical inspection that claimed animals have been correctly identified with two matching official identifiers and breed, sex, age and location of the claimed animals match the submitted claim details

- that your herd register contains all mandatory birth, movement and death information as applicable. We may also check supporting documents, such as purchase and sales receipts and slaughter certificates

- That claimed animals have a valid official passport

- That CTS / ScotMoves have been notified of births, movements and deaths of claimed animals as applicable.

- As a keeper of cattle, your identification and traceability requirements can be found in the Cattle Keeper's Handbook

Penalties

General

You will lose some or all of your payment if you do not meet the rules of the scheme and the undertakings you give.

You may be prosecuted if you knowingly make a false statement to receive payment for yourself or for someone else.

So it’s important to make sure you understand your responsibilities we would advise you to seek professional advice if you need it.

Scheme penalties

You may face a penalty if you claim for animals that do not meet the rules of the scheme.

If we find a difference between the number of animals you claim in a scheme year and the number of animals that are eligible, we will reduce your payment using a percentage error rate.

To find the percentage error rate, we divide the number of animals found to be not eligible by the number of animals that are eligible – example below. We have five levels of penalties.

Penalty level one applies when the number of non-eligible animals found is no more than three.

- level one – we will reduce your payment by the percentage error rate

Penalty levels two, three, four or five apply when the number of non-eligible animals is four or more.

- level two – if the percentage error rate is a maximum of 10 per cent, we will reduce your payment by the percentage error rate

- level three – if the percentage error rate is more than 10 per cent to a maximum of 20 per cent, we will reduce your payment by twice the percentage error rate

- level four – if the percentage error rate is more than 20 per cent, we will not pay you under that year’s scheme

- level five – if the percentage error rate is more than 50 per cent, we will not pay you under that year's scheme. Additionally, we will also apply a fine which will be recovered from any other payments you are entitled to over the following three scheme years. The fine will be determined by calculating the difference between the claimed and determined number of animals multiplied by the payment rate per animal for the scheme year concerned

For example:

| If you claim 100 animals but 10 of these are not eligible, the percentage error calculation would be: |

|---|

| 10 (animals not eligible) ÷ 90 (remaining eligible animals) x 100 = 11.1% |

| This is a level three penalty. This means that we pay premium on 90 animals and reduce the payment by 22.2 per cent. |

False declaration

If you knowingly make a false statement in an application, we will apply a fine to other payments you are entitled to over the following three scheme years.

The fine will be equivalent to the payment you would have received had there been no errors in your application.

Penalties for not following Cross Compliance

You may face a penalty:

- if you do not keep your land in good agricultural and Environmental Condition (GAEC)

- if you do not keep to the statutory management requirements (SMR), which include the animal identification regulations

- More information can be found in our Cross Compliance section

Penalties for using banned substances

We may exclude you from the scheme for a year if we find:

- that you have used banned substances (for example, hormones) on your animals or we find these substances on your premises

- we find residues of substances in your animals (for example, medicines) which you have used illegally, or we find these substances stored illegally on your premises

If we exclude you from the scheme for using banned substances and you repeat this offence, we may exclude you for up to five years. If you prevent us from inspecting your holding or taking samples to check for banned substances, we may exclude you from the scheme.

Returning your Single Application Form (SAF) late

If we receive your Single Application after the deadline we will reduce your payment. You can find out more about the Single Application Form and how to complete it online below.

Using our online service is the quickest and easiest way to submit your form each year.

Declarations and undertakings

You must read the declarations and undertakings at section three of your claim form carefully before you sign the form.

Payments

General

We can pay you in sterling or euros. We will pay you in sterling unless you tell us on your Single Application Form to pay you in euros.

We will make payments to your business’ nominated bank account using BACS.

We can only pay into a United Kingdom bank account held in the name of the business. You must provide your business bank account details to allow us to pay you.

Payments by BACS

If we already hold bank account details for your business we will use those.

If you want to change your bank account details, or provide them for the first time, you need to fill in and return the form below.

A paper copy of this form is also available from your local area office. Please keep your BACS details up to date to avoid payment delays.

Payment rates

The payment rate for eligible animals is not fixed. The rate will vary each year depending on the total number of eligible animals claimed in the calendar year. We pay a flat rate for each eligible animal. The following were the rates for 2018.

- for eligible animals claimed by businesses whose main Location Code is on mainland Scotland the payment rate for 2018 is €110.80 per animal

- for eligible animals claimed by businesses whose main Location Code is on a Scottish island, the payment rate for 2018 is €161.60 per animal

For both, payments in sterling depends on the 2018 exchange rate.

The

2019 rates will be set once the total number of eligible animals claimed that year is known. Payments in sterling will depend on the 2019 exchange rate.

Financial Discipline

If the overall European Union budget for market support measures and direct payments is in danger of being exceeded, there is a mechanism (Financial Discipline) which reduces payments being made across all European Union member states.

This provision is designed to protect European Union taxpayers from budget increases. If we are required to implement the Financial Discipline, we will provide further information with your payment.

Our targets

We can only process your claim if you fill it in correctly and include all the documents we need to support it.

We aim to:

- acknowledge your claim by letter within 14 days

- to pay all eligible claims by 30 June following the end of each scheme year

Information about you and your payments

How we manage your information is set-out in our Privacy Policy, which you can read below.

Appeals and complaints

If you are unhappy with a decision we have made regarding your claim or if you are unhappy with the service we have provided you with, you can make use of our appeals and complaints procedures.

You can find out more about both below.

Legal base

Our legal authority for this scheme is in two parts.

- European Parliament and the Council Regulation 1307/2013 that deals with the basic rules of the scheme

- European Parliament and Council Regulation 1306/2013 that deals with requirements that are more general

Both regulations are supplemented with other regulations. Copies of all these are available on the European Union website.

If you would like to know the full range of regulations, speak to your local area office.

We aim to provide as much guidance as possible on the scheme. But these notes do not provide a full statement of the law, something which only the European Court of Justice can give.

If you have any legal questions, you should get appropriate legal advice from a solicitor.

Annex A – non-eligible breeds

- Armoricaine

- Ayrshire

- Ayrshire Cross

- Black and White Friesian

- Belted Dutch

- Belted Dutch Cross

- Bretonne Pie-Noire

- British Friesian

- British Friesian Cross

- British Holstein

- British Holstein Cross

- Brown Swiss

- Brown Swiss Cross

- Cross breed Dairy

- Dairy Shorthorn

- Dairy Shorthorn Cross

- Deutsche Schwartzbunte and Swartzbunte Milchrasse

- Estonian Red

- Estonian Red Cross

- Francaise Frisonne Pie Noire

- Fries Holland

- Frisona Espagnola

- Frisona Espagnola Cross

- Frisona Italiana

- Friesian

- Friesian Cross

- Groninger Blaarkop

- Guernsey

- Guernsey Cross

- Holstein Friesian

- Holstein Friesian Cross

- Holstein

- Holstein Cross

- Jersey

- Jersey Cross

- Kerry

- Kerry Cross

- Northern Dairy Shorthorn

- Red and White Friesian

- Reggiana

- Red and White Friesian

- Sortbroget Dansk Maelkerace

- Swiss Gray

- Swedish Red

- Swedish Red Cross

- Swedish Red and White

- Yak

- Zwartbonten van Belge / Pie-Noire de Belgique

- or any other dairy breed

Annex B – single sheet passport example

Annex C – written list of animals to claim

Recent changes

| Section | Change |

|---|---|

| Force majeure/exceptional circumstances | New section added |

| Payments | Figures updated for 2017 |

Previous versions

Download guidance

Click 'Download this page' to create a printer-friendly version of this guidance that you can save or print out.