National Reserve Full Scheme Guidance

This is an old version of the page

Date published: 26 May, 2016

Date superseded: 19 January, 2017

Introduction

In Scotland, the Basic Payment Scheme was introduced from 1 January, 2015. This replaced the Single Farm Payment.

- all existing Single Farm Payment Scheme payment entitlements ceased to exist on 31 December, 2014

- new Basic Payment Scheme payment entitlements were allocated to eligible farmers who applied in 2015

You can find out more about the Basic Payment scheme here

This information for farmers should not be regarded as an authoritative legal interpretation of the European Commission’s regulations governing the Basic Payment Scheme or the National Reserve.

You are advised to take independent professional advice to make certain you understand what you are applying for.

Before you apply

If you are a new customer you must register your business details.

The easiest way to do this is online

You can also download the form below to register or re-register.

PF01 – Register a Business Form

You must provide us with the National Insurance numbers for all members of the business.

If you plan to declare land on your Single Application Form which was not previously registered with us you must complete PF06 – Land Maintenance Form and provide supporting maps to register it.

Hard copies of these forms are available from your local area office.

Legislative base

This guidance explains the rules of the European Council Regulation 1307/2013, for allocating Basic Payment Scheme payment entitlements to:

- farmers who can prove they undertook an agricultural activity on 15 May, 2013

- farmers who are eligible under a category of the National Reserve

- farmers who have entered into a private contract clause as part of a sale or lease agreement

More detailed legislative requirements relating to the allocation of payment entitlements are contained in Commission Delegated Regulation 639/2014 and Commission Implementing Regulation 641/2014.

Artificiality

We will undertake checks on all applications to make sure they are genuine.

You won’t be eligible for entitlements if you have artificially created the conditions to qualify for an allocation. Seeking to obtain an advantage in this way is contrary to the objectives of the scheme.

National Reserve Overview

The National Reserve is the name we give to the pool of money taken from the total funds available for the Basic Payment Scheme in Scotland.

It is used to allocate payment entitlements, as a priority, to Young Farmers and New Entrants to farming.

National Reserve entitlements will be allocated based on the payment region your land is in.

You can find out more about payment regions here

The European Commission allows for up to three per cent of the Scottish Basic Payment Scheme budget to be used to establish the National Reserve.

This amount can be increased to meet demand for the New Entrants and Young Farmer categories, which we must allocate to as a matter of priority, as well as the specific disadvantage category.

The National Reserve will be replenished annually from a number of sources, including:

- any Basic Payment Scheme entitlements that have not been activated for payment during two consecutive years

- any Basic Payment Scheme entitlements voluntarily returned or found to have been unduly allocated

- reducing the value of already allocated Basic Payment Scheme entitlements. This would be done to ensure there is enough budget to meet the demand from New Entrants and Young Farmers applying to the National Reserve, or to respond to court rulings

Key dates

- 15 June - the deadline for the 2016 Single Application Form and all supporting documentation without penalty

- 11 July – deadline to make amendments to your SAF or submit supporting documentation that will be subject to late penalties

National Reserve categories

If you want to submit an application for an allocation of Basic Payment Scheme entitlements you must complete your Single Application Form (SAF) application online. For 2016 onwards, the only route to entitlement allocation is via the National Reserve and there are two categories you can apply under, they are:

- New Entrant - if you started an agricultural activity in 2013 or later and did not have activity in your own name or at your own risk in the five years preceding the start of the activity

- Young Farmer - if you are less than 41 years of age on 31 December of the year you apply for an award and are setting up for the first time an agricultural holding as head of the holding.

There is no paper application for National Reserve. To submit an application to the National Reserve you must complete your SAF online as the application is contained within the SAF.

If you were successful under either of the above categories in 2015, you will not be able to receive a further allocation in 2016, or subsequent years, for any additional land you may have taken on.

New Entrants

This category is available to sole traders, partnerships, or a legal person, for example a limited company, that started farming in 2013 or later.

- if you wish to be considered for entitlements as a sole trader, you must not have carried out any agricultural activity in your own name or at your own risk in the five years before the start of your current farming activity

- if you wish to be considered for entitlements as a partnership, none of the partners can have carried out any agricultural activities in their own name or at their own risk, or as the person in control of, for example, a limited company (i.e. legal person), in the five years before the start of the partnership’s current agricultural activity

For legal persons, the controlling members must not have carried out agricultural activities in their own name or at their own risk.

Also, they should not have had the control of a legal person exercising an agricultural activity, in the five years before the start of the current agricultural activity exercised by the legal person.

Working on a farm (for example, as a farm manager or a farm labourer) would not be considered as undertaking an agricultural activity.

You must submit your first application for Basic Payment Scheme no later than two years after the calendar year in which you started the current agricultural activity.

This means that if your business started in 2014, the last year in which you can apply to the National Reserve is 2016.

Documentary evidence must be submitted with your application to confirm the date the agricultural activity commenced. This could be one or more of the following:

- confirmation of the date the holding was registered

- registration with British Cattle Movement Service (BCMS) / Animal Movement Licensing System (AMLS)

- animal record books

- pesticide records

If your National Reserve application is successful and you have submitted a 2016 Single Application Form, declaring at least three hectares of eligible land, and you meet the criteria for being an active farmer, you will be allocated a number of Basic Payment Scheme entitlements.

This will be equal to the number of eligible hectares that you declare on your 2016 Single Application Form and that are 'at your disposal' on 15 May, 2016.

They will be valued at the average entitlement rate per payment region in the year they are allocated and will move in equal steps to the final rate in 2019.

Those who already hold Basic Payment Scheme entitlements and also qualify under the National Reserve will have the value of those entitlements topped up to the average entitlement rate for that payment region applicable in the year of application.

Young Farmers

This category is available to sole traders and members of partnerships or limited companies who are less than 41 years of age on 31 December of the first year they apply for the Basic Payment Scheme.

They must be setting up for the first time as head of holding or have control of a partnership / legal person (eg, limited company) in the five years before submitting their first application for Basic Payment Scheme.

This could be setting up a new business or taking over an existing business.

- the minimum age of the Young Farmer becoming head of holding or taking control as a sole trader or partnership is 16 years of age at the time that they become head of holding or take control of the partnership

- the minimum age of the Young Farmer becoming head of holding or taking control of a legal person (for example, a limited company) is 16 years of age at the time that they become head of holding or take control of the legal person

Sole trader

If you wish to be considered for entitlements as a sole trader, in addition to being less than 41 years of age on 31 December of the first year you apply for the Basic Payment Scheme, you must have set up a new holding as head of that holding.

Partnership

If you wish to be considered for entitlements under the Young Farmer category and are a partnership, at least one member of the partnership must be less than 41 years of age on 31 December of the first year they apply for the Basic Payment Scheme.

That member of the partnership must be capable of exercising effective and long-term control of the partnership in terms of decisions related to management, benefits and financial risks. This control can be exercised either alone or jointly with another member of the partnership other members of the partnership not need to be less than 41 years.

Where there is joint control, the Young Farmer must be able to demonstrate that they make the decisions as detailed above.

Partnerships will need to supply documentary evidence demonstrating that the person who is less than 41 years old is capable of exercising the effective and long-term control of the partnership as detailed above.

In the case of a Young Farmer taking over as head of holding or taking control of an existing partnership, documentary evidence must be supplied demonstrating how they exercise control of the partnership.

As an example, this could include being entitled to a majority share of profits. In this case we would require a letter from a solicitor or accountant confirming the set-up of the partnership or how the share of profits are divided among the partners.

Limited company

For legal persons – for example a limited company – a member of the company less than 41 years old on 31 December in the year of submitting the first application for Basic Payment Scheme would need to be exercising effective control of the company in terms of decisions related to management, benefits and financial risks.

If the limited company consists of members of various ages, the member who is less than 41 years of age must be capable of exercising effective control of the company for example as managing director.

As detailed above, this control can be exercised either on their own or jointly with another member of the Company (who does not need to be 40 years of age or less).

Checks will be undertaken with Companies House to establish the make-up of limited companies. Where such checks prove inconclusive, documentary evidence may be requested in support of the application.

Evidence

Documentary evidence must be provided in all cases to prove date of birth, either a birth certificate or passport or driving licence.

In all cases you must also submit documentary evidence with your application to prove that the Young Farmer is head of the holding or has control of the partnership / legal person. This could be one or more of:

• Company Articles of Association

• accountants / solicitors letter confirming partnership constitution

• bank accounts / accountants letter to confirm share of profits

• bank letter confirming who has the authority to sign cheques

• any other documentary evidence you feel is appropriate or which we may reasonably request when considering an application

Allocation

If your National Reserve application is successful and you have submitted a 2016 Single Application Form declaring at least three hectares of eligible land you will be allocated a number of Basic Payment Scheme payment entitlements.

These will be equal to the number of eligible hectares that you declare on your 2016 Single Application Form and that are 'at your disposal' on 15 May, 2016.

The Basic Payment Scheme payment entitlements will be valued at the average entitlement rate per payment region classification in the year they are allocated and will move in equal steps to the final rate in 2019.

Those who already hold Basic Payment Scheme entitlements and also qualify under the National Reserve will have the value of those entitlements topped up to the average entitlement rate for that payment region applicable in the year of application.

There is an additional payment under the Basic Payment Scheme for Young Farmers called the Young Farmer payment which will need to be claimed for on the 2015 Single Application Form.

Calculating National Reserve entitlements

All Basic Payment Scheme payment entitlements, including entitlements allocated from the National Reserve, can only be activated using land in the Scottish payment region in which they have been allocated.

Final calculations can only be completed once the majority of applications and claims that are submitted in 2015 have been checked.

You will be notified by 31 December, 2015 of the provisional number and value of entitlements for the period 2015 to 2019.

We will write to all customers by April 2016 to confirm their definitive number and value of entitlements.

Usage rules

All Basic Payment Scheme payment entitlements, including entitlements allocated from the National Reserve, are subject to a two-year usage rule.

The rule has changed, compared to the two-year usage rule that was in place for the Single Farm Payment Scheme.

From 2015, over any two-year period you must activate (use) all of your Basic Payment Scheme payment entitlements in at least one year.

Therefore it will not be possible to rotate entitlements using some in year one and the remainder in year two.

If you lease your Basic Payment Scheme entitlements out, you will be relying on that farmer to ensure the two-year usage rule is met.

If leased-in Basic Payment Scheme entitlements are not activated during the rolling two-year period they will revert to the National Reserve.

For example:

in the case of a farmer who had 50 Basic Payment Scheme entitlements allocated (and activated) in 2015, who then activates 30 Basic Payment Scheme entitlements in 2016 and 50 Basic Payment Scheme entitlements in 2017, they will have activated all 50 entitlements at least once in the two-year period

however, if they had activated only 40 entitlements in 2017, they have not activated all 50 entitlements once in the two year period and the 10 entitlements not used will be withdrawn and revert to the National Reserve

The lowest value entitlements (owned or leased-in) will revert to the National Reserve first.

You may be exempt from the two-year usage rule if you can prove that you (or your business) were subject to exceptional circumstances or a force majeure event, which prevented you from activating the entitlements for the relevant Basic Payment Scheme year.

How to apply

If you want to submit an application for an allocation of Basic Payment Scheme entitlements you must complete your Single Application Form (SAF) application online.

For 2016 onwards, the only route to entitlement allocation is via the National Reserve and there are two categories you can apply under, they are:

- New Entrant - if you started an agricultural activity in 2013 or later and did not have activity in your own name or at your own risk in the 5 years preceding the start of the activity

- Young Farmer - if you are less than 41 years of age on 31 December of the year you apply for an award and are setting up for the first time an agricultural holding as head of the holding.

There is no paper application for National Reserve, to submit an application to the National Reserve you must complete your SAF online as the application is contained within the SAF.

If you were successful under either of the above categories in 2015 you will not be able to receive a further allocation in 2016, or subsequent years, for any additional land you may have taken on.

We require originals of some documents.

Postage and delivery of your application and supporting information is your responsibility. Any delay in receiving your information may result in penalties or rejection, and subsequent loss of payments.

If you are sending supporting evidence by post, recorded delivery is advisable. However, recorded delivery is not a guarantee that your documentary evidence will be received by the us before the deadlines mentioned above.

Original documents received by post will be copied and sent back to you by return. Original documents brought in to one of our offices will be copied and returned to you at the time.

Cross-border holdings

If you have land in Scotland and wish to be considered for Scottish entitlements, you need to apply as set out above.

If you wish to be considered for Basic Payment Scheme entitlements in another part of the UK you should complete the application form from the relevant paying agency in England, Wales or Northern Ireland.

Transfer of Entitlements

This guidance provides further information about the transfer of Basic Payment Scheme payment entitlements through sale, lease or inheritance.

You must read this guidance carefully before you complete a PF23 – Application to transfer entitlements form.

RPID also has a specialist unit to help with queries about the transfer notification process. If you need further more information after reading this guidance, please contact:

Rural Payments and Inspections Division

Entitlement Transfer Unit (ETU)

10 Keith Street

Stornoway

HS1 2QGTelephone: 01851 702392

Fax: 01851 705793

Email: EntitlementTransferUnit@gov.scot

Please note, this guidance does not cover the transfer of entitlements for:

- business splits

- business mergers

- whole holding transfers

There is specific guidance and requirements to be considered before these types of transfer can be authorised.

Contact your local RPID area office for this information.

Background

Scottish entitlements are only tradable within Scotland: the EU Regulations governing the Basic Payment Scheme allow farmers and crofters who have established their entitlements to transfer these to others, but those receiving entitlements must be farmers within the same region.

To establish their entitlements, farmers had to submit a 2015 Single Application Form, and, where required, complete an allocation of entitlements application form, fulfilling various conditions, after which they were free to transfer, subject to other rules surrounding transfers in general.

Are you eligible to transfer your entitlements?

If you own Basic Payment Scheme entitlements you may be eligible to transfer them. This includes entitlements allocated to you in 2015, and those you have since been allocated, have purchased or have inherited.

You can transfer your entitlements with or without land, subject to the conditions laid down in Part 2. You can sell your entitlements, or lease them for a specific period, after which at the end of the lease we will return them to you.

The person or business that will take over your entitlements must meet the definition of a ‘farmer' as determined by the European Regulations at the time of transfer. That is a natural or legal person (or a group of natural or legal persons) whose holding (production units) is situated within Scotland, and who exercises an agricultural activity.

An agricultural activity means:

- the production, rearing or growing of agricultural products, including harvesting, milking, breeding animals, and keeping animals for farming purposes

- maintaining an agricultural area in a state which makes it suitable for grazing or cultivation

or

- carrying out a minimum activity on agricultural areas naturally kept in a state suitable for grazing or cultivation. In Scotland, this is all land assigned to Payment Regions 2 and / or 3

Refer to the full Basic Payment Scheme guidance for more information on agricultural activity.

Please note: If the buyer or lessee does not meet this definition the request to transfer will be rejected.

A key part of the ‘farmer’ definition is the requirement to have an agricultural holding (production units). The minimum size of a holding is 0.3 hectares. However, to receive payment under the Basic Payment Scheme, an applicant must declare a minimum of three hectares of eligible land. Please note that we may ask for evidence to prove that the transferee is indeed a ‘farmer’ at the time of transfer.

Payment entitlements may only be transferred within the same Basic Payment Scheme payment region, except in case of inheritance. This means that if you are transferring payment entitlements without land, you can only transfer them to a business who holds land in the payment region to which the entitlements are assigned. Payment entitlements can only be activated for payment by land assigned to the same payment region as them. For example, you cannot activate Payment Region 1 entitlements using Basic Payment Scheme eligible land assigned to Payment Region 2.

We calculate payment entitlements to two decimal places. This means you can transfer fractions of entitlements that are no smaller than 0.01 hectares.

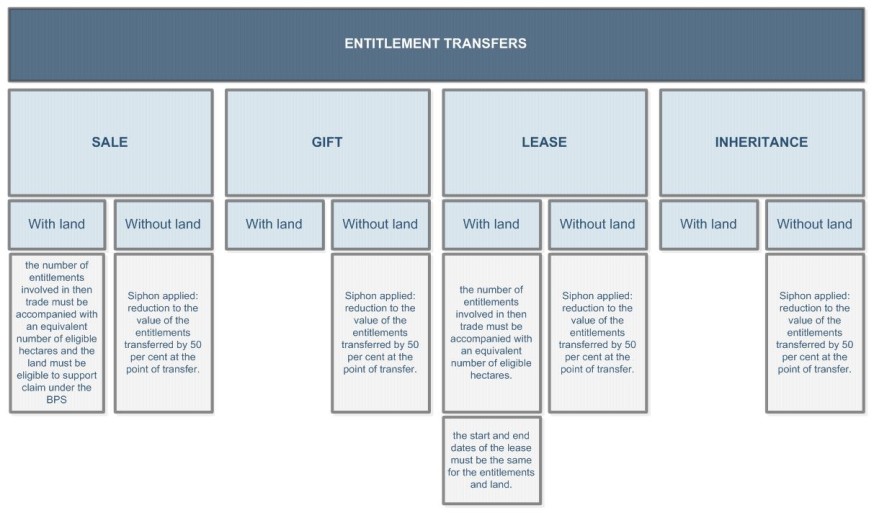

The types of transfer

The European Regulations allow entitlements to be sold or leased; entitlements can also be transferred to another farmer as a gift, or through inheritance. All these types of transfer can be done with or without land.

If you wish to trade you can do so through a private arrangement with another farmer or between your representatives (solicitors or advisory firm). Alternatively, you can buy or sell publicly through brokers and auction marts.

If you lease with land, the start and end dates of the lease must be the same for the entitlements and land.

To apply under inheritance the executor should complete a PF23 – Application to transfer entitlements form. Supporting documents must be provided with the application (for example, a copy of a will or any relevant legal documentation).

If you transfer entitlements with land you must do so with an equivalent number of eligible hectares and the land you transfer must be eligible to support a claim under the Basic Payment Scheme.

An assignation between an outgoing tenant (assignor) and incoming tenant (assignee), with the landlords consent, will be considered as a transfer with land. The documentation supporting any transfer of this type should clearly state that the transfer is assignation.

If you transfer entitlements without land, we will apply a siphon and will reduce the value of the entitlements transferred.

The European Regulations governing the implementation of the Basic Payment Scheme contain a provision to apply a siphon on all entitlements traded without land. Scottish Ministers, through a public consultation, asked for views on the use of this option, the result of which now leads to a reduction to the value of the entitlements transferred by 50 per cent at the point of transfer.

Convergence will apply to the post siphon value to ensure all payment entitlements within a region are the same value in 2019.

Please bear in mind that we cannot get involved in any disputes between parties because of siphon reduction when your sales agreement is finalised.

Note that although the value deducted will be lost to the transferee, it will go to the National Reserve and help provide additional funds for other farmers.

If the tenant owns the payment entitlements and transfers them to the landlord at the end of a seasonal let or tenancy agreement, the transfer will be considered a transfer without land and the entitlements will be subject to siphon.

When can I transfer my entitlements?

You can transfer your entitlements at any time but you must tell us about all transfers within the ‘notification period’. This begins on 16 May of the calendar year preceding the first year the transferee could include the entitlements in a claim for the Basic Payment Scheme, and it ends on 2 April in the first calendar year the transferee could include the entitlements in such a claim.

Help us process your application by giving us as much advance notice as you can. To allow us time to carry out administrative checks against your application, such as a validation check against our field register, please send a PF23 – Application to transfer entitlements form to the Entitlement Transfer Unit at least six weeks before the effective date of transfer.

Be aware that we may not be able to finalise our checks within six weeks if you are transferring entitlements that could potentially be subject to confiscation because of non-usage. If your application falls under this category we will write to let you know.

Note that if you intend to transfer your entitlements in time for the Basic Payment Scheme you must complete a PF23 – Application to transfer entitlements form and send it to the Entitlement Transfer Unit by 2 April.

This is because there is a ‘notification period’ set in Regulation which begins on 16 May of the calendar year preceding the first year the transferee could include the entitlements in the claim for the Basic Payment Scheme and ends on 2 April in the first calendar year the transferee could include the entitlements in such a claim.

When 2 April is a Saturday, Sunday, bank holiday or other public holiday, the date falls to the next working day. As 2 April, 2016 falls on a Saturday, the date for the 2016 was changed to 4 April.

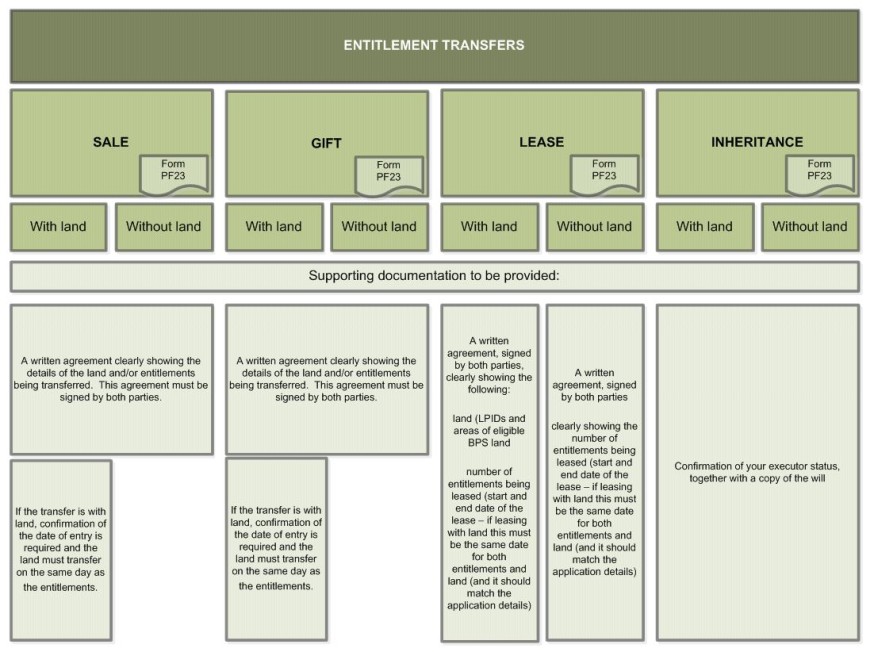

The application process

Please send a PF23 – Application to transfer entitlements form to the Entitlement Transfer Unit.

You must provide confirmation of the number of entitlements being transferred and whether the transfer is with or without land together with the following information for each of the categories below:

Sale or other (for example, a gift). A written agreement clearly showing the details of the land and / or entitlements being transferred. If the transfer is with land, confirmation of the date of entry is required and the land must transfer on the same day as the entitlements. This agreement must be signed by both parties. An example of an agreement for a transfer without land is available at Appendix A below.

Lease. A written agreement, signed by both parties, clearly showing the following:

- land (LPIDs and areas of eligible Basic Payment Scheme land (if leasing with land)

- number of entitlements being leased (start and end date of the lease – if leasing with land this must be the same date for both entitlements and land (and it should match the application details)

Inheritance (confirmation of your executor status, together with a copy of the will).

You can make multiple transfers (for example, some entitlements with land and some entitlements without land) using the same form, as long you are transferring these to the same business. Otherwise you must use a separate form for each transfer.

Who will receive the payments?

We will pay on entitlements held as at 15 May. So, the effective date of transfer will determine who gets paid in any given year. For example, if you wish the transferee to receive payment, you must inform us on or before 2 April [*]. If it takes place after 2 April, any payment that is due will go to you if you have submitted a valid Single Application Form.

Note that if for any reason we have to reject your application, and you have submitted it near to 2 April (as explained above), you will not be able to submit another application in time to allow the transferee to claim for the entitlements in that year. In this scenario you will be the one responsible for the use of these entitlements in that year.

Both parties should also be aware that if after finalising a transfer we discover that the seller / lessor should not have been awarded the entitlements, we must take back the appropriate entitlements and ask both parties to repay, with interest, any monies not due to them.

Recipients of traded entitlements are still subject to scheme conditions and eligibility criteria for payment. In order to receive payment under the Basic Payment Scheme, all farmers and crofters must have eligible land at their disposal, and be engaged in a recognised agricultural activity.

Legal base

The trading of entitlements is permitted under Article 34 of Regulation (EU) No 1307/2013, Article 25 of Commission Delegated Regulation (EU) No 639/2014 and Commission Implementing Regulation (EU) No 641/2014.

Appeals and Complaints

If you wish to know more about making an appeal or a complaint please check out these links

Apenndix A

Download Guidance

Download guidance

Click 'Download this page' to create a printable version of this guidance you can save or print out.