Business types

Date published: 15 April, 2015

Table of Contents

- How to register different business types

- Sole trader

- Partnership (including forestry investment funds and other models)

- Registered company

- Charity

- Groups or association

- Trusts

- Pension funds

- An estate in trust (managed by an executor)

- Company in administration / receivership

- Local authorities and other public bodies

How to register different business types

To make sure we understand the nature of the business you represent and what your role in it is, and in order to meet the regulatory, audit and security requirements placed on us, we will ask you to tell us who fulfils certain roles within your business. These roles are:

Business Member: These are individuals who own or control the business and who receive benefit from the activity of that business and hence from any grant or subsidy that we pay. In some cases, there are no individual beneficiaries of a business entity.

The guidance below will help you to decide who you should record in this role, depending on the nature of the business.

Responsible Person: This is the person who takes responsibility for ensuring that information we hold about the business is accurate, and for authorising (mandating) a third party such as an Advisory Firm to act for the business.

A Responsible Person can also authorise someone within their own business (a “Business Representative”) to carry out transactions on behalf of the business.

Advisory Firm: This is a company that acts on behalf of or represents a business, but is not part of it. Any of the business types listed below may mandate an Advisory Firm to act on their behalf.

The arrangements for businesses can be complex or open to interpretation. If we do not have a clear understanding about the structure of your business, or require evidence of its arrangements, we will seek further information and may approach you for this information at any time.

If you have any difficulty in identifying and selecting your business type from the types available on the Rural Payments System, then please select the type ‘Other’ and we will advise if we need you to provide further information.

Sole trader

A single person is able to take business decisions and is the sole beneficiary from the business.

| Register a sole trader | ||

|---|---|---|

| Responsible Person | The sole trader | |

| Business Members | The same | Will be automatically entered by the system |

Mandating: A sole trader may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us.

Partnership (including forestry investment funds and other models)

Partnerships have two or more individuals who will benefit from the business activity. Some partnerships, particularly when based around family structures, have no formal partnership agreement, but many do.

Regardless of the partnership type or structure the same principles for registration will apply.

| Register a simple partnership | ||

|---|---|---|

| Responsible Person | One of the partners | You must be confident that you can respresent the partnership as a whole |

| Business Members | The remainder of the partners | |

Some forestry investment funds are constituted as Partnerships Limited by Guarantee, and these are cases where the number of partners can be very large.

Usually these funds are constituted so that decisions about the management of the land are in the hands of Directors.

Effectively, the members of the partnership are in the position of shareholders, with limited control over the running of the fund.

| Registering a partnership where management is in the hands of directors | ||

|---|---|---|

| Responsible Person | A director of the fund or partnership | Please do not include your NI number *. You must be confident that you can represent the partnership as a whole |

| Business Members | None | Partners should not be listed as business members |

In some cases, decisions on management of the land are retained by all partners, and in these cases all partners must be registered as Business Members.

| Registering a partnership where management is in the hands of all partners | ||

|---|---|---|

| Responsible Person | One partner | You must be confident that you can represent the partnership as a whole |

| Business Members | The remainder of the partners | |

Mandating: A partnership may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us. An example would be where a forestry investment fund mandates a forestry manager to undertake its land management activity.

Registered company

Most companies are registered with Companies House and have a company number. The owners of the company are the Business Members: they may be some or all of the Directors of the company, but (particularly in larger companies) some or all Directors may be salaried employees.

We need to record the ultimate owners of the company as the Business Members.

Some registered companies, particularly forestry companies, provide a fund management service where they own and manage forestry assets, and so are beneficiaries of the activity in their own right. These business must register in their own right.

In some cases, one or more of the owners of a company will be another registered company. In this case we need to record the owners of that parent company as Business Members, along with any separate owners of the child company. See example below:

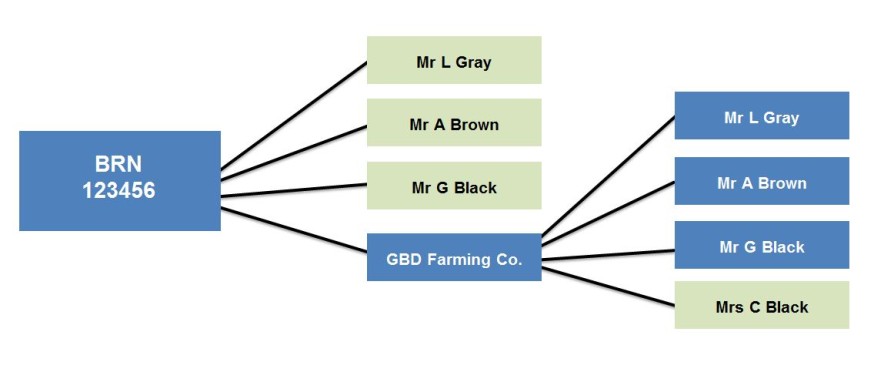

Example: BRN 123456 is a partnership.

One of the partners is a limited company. We need to record the independent partners as business members and then trace the beneficiaries in the company.

In this example, three of the directors in the company are the same as the partners. A fourth director is unique to the company.

We record the fourth director as a business member of BRN 123456.

| Registering a registered company | ||

|---|---|---|

| Responsible Person | One of the owners. | You must be confident that you can represent the company as a whole. |

| Business Members | The remainder of the owners. Additional owners of any parent company or companies. | Do not include shareholders unless they also have an executive role. |

Mandating: A registered company may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us.

Examples would be where a farming company employs an agent to handle aspects of the business for them, or where a forestry company manages assets owned by a business.

Charity

Charities must be registered with the appropriate regulator for their work and operations and have a charity number. Some non-profit and charitable organisations may not be registered charities.

In that case, they should be treated according to their formal constitution as companies, groups, etc.

Charities do not have individual beneficiaries, and therefore the Responsible Person is simply someone with authority to represent the organisation.

For example, in UK-wide bodies such as RSPB, this may be someone with authority to represent the organisation within Scotland. No Business Members should be recorded.

| Registering a charity | ||

|---|---|---|

| Responsible Person | Someone with authority to represent the organisation | Please do not include your NI* number |

| Business Members | None | |

Mandating: A charity may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us.

Groups or association

Groups will consist of a number of individuals operating as an entity and benefiting from the business activity. Groups may or may not be legally constituted as such.

There are some specific types of group which commonly register with us, such as Common Grazing Committees and Sheep Stock Clubs.

In these cases, while there may be shareholders who benefit from any surplus, the beneficiaries with control over the group are the committee members.

| Registering a Common Grazing Committee or Sheep Stock Club | ||

|---|---|---|

| Responsible Person | An office bearer of the group | You must be confident that you can represent the group as a whole |

| Business Members | All other committee members | Shareholders should not be listed as Business Members |

Some groups or associations have no individual beneficiaries. Examples include a community group or informal charitable grouping. In these cases, similar details should be supplied, but only to ensure accurate identification of the group.

| Registering a group with no individual beneficiaries | ||

|---|---|---|

| Responsible Person | An office bearer of the group | Please do not provide your National Insurance number* |

| Business Member(s) | None | |

Mandating: A group or association may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us.

Trusts

A trust is an entity which holds property and carries out business activity for the benefit of another party.

The beneficiary/ies may be an individual or a group of individuals (such as members of a family). Sometimes, a registered company or another trust is a beneficiary (or even the only beneficiary) of a trust.

In this case, we will require information concerning the beneficiaries of that company or trust. Trustees may or may not themselves be beneficiaries.

|

Registering a trust where there are individual beneficiaries |

||

|---|---|---|

| Responsible Person | One of the individual beneficiaries of the trust or One of the owners of the company or trust which is beneficiary of the trust | |

| Business Member(s) | The individual beneficiaries of the trust and All other owners of the company or trust (if any) which is beneficiary of the trust | |

In rare cases, no individual beneficiary may exist or may be legally incapable of exercising control over the business (for example, a minor). In these cases, identification of trustees is required to ensure accurate identification of the trust.

| Registering a trust where there are no individual beneficiaries | ||

|---|---|---|

| Responsible Person | One of the trustees | Please do not provide your NI Number* |

| Business Member(s) | None | |

Mandating: A trust may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us.

Pension funds

Pension funds are the investment vehicles that provide their members with a retirement income.

Pension funds are registered with HMRC and the pensions regulator and are governed by trustees. Trustees can be employees of the company running the scheme, representatives of the scheme members or independent people appointed for their skills and knowledge.

The trustees may themselves be beneficiaries, but they serve as representatives of the wider body of beneficiaries.

| Registering a pension fund | ||

|---|---|---|

| Rsponsible person | One trustee | Please do not include your NI Number* You must be confident that you can represent the fund as a whole |

| Business member(s) | None | |

Mandating: A pension fund may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us. An example would be where pension fund managers are mandated as the technical/financial experts who administer the fund on behalf of the trustees.

An estate in trust (managed by an executor)

This is the case where property is held in trust following the death of, for example, a sole trader. Until the estate is wound up and passed to inheritors, there is effectively no beneficiary (and at this stage, the entity may cease to exist and the property pass to different or new ownership).

If the business is already registered at the time that the beneficiary dies, the executor or other trustee should request to take on the role of Responsible Person in order to manage the business activity of the deceased’s estate.

| Registering an estate in trust | ||

|---|---|---|

| Rsponsible person | Someone with authority to represent the executor(s) | Please do not include your NI Number* |

| Business member(s) | None | |

Mandating: An executor may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us.

If there were existing mandates, for example, to allow an Advisory Firm to manage the business, those mandates will continue until or unless the new Responsible Person chooses to change them.

Company in administration / receivership

This is the case where property is administered by someone appointed for the purpose following bankruptcy or other event which causes a company to cease trading.

Until the company is wound up and its assets distributed, there is effectively no beneficiary. If the business is already registered at the time that it enters administration, the administrator should request to take on the role of Responsible Person in order to manage the business activity of the company.

| Registering a company in administration/receivership | ||

|---|---|---|

| Rsponsible person | Someone with authority to represent the administrators or receivers | Please do not include your NI Number* |

| Business member(s) | None | |

Mandating: An administrator may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us.

If there were existing mandates, for example, to allow an Advisory Firm to manage the business, those mandates will continue until or unless the new Responsible Person chooses to change them.

Local authorities and other public bodies

Local authorities and other public bodies have no individual beneficiaries and hence no Business Members.

| Registering a local authority or other public bodies | ||

|---|---|---|

| Rsponsible person | Someone with authority to represent the body in respect of its relevant business activity | Please do not include your NI Number* |

| Business member(s) | None | |

Mandating: A public body may mandate an Advisory Firm to act on their behalf in some or all of their dealings with us.

*Important note: On the Rural Payments and Services system, it is currently necessary to declare that you have 'No UK National Insurance number' in order to allow the form to be saved or submitted. Please include the text 'Not a beneficiary' in the explanatory comment requested by the system.