Fallen Stock Support Scheme 2018

Date published: 24 April, 2018

Fallen Stock Support Scheme

A £250,000 fund to provide assistance towards some of the additional costs of dealing with fallen sheep and cattle stock was announced by the Cabinet Secretary for the Rural Economy and Connectivity on Wednesday 18 April 2018.

Purpose of scheme

The scheme will provide support towards the additional costs of arranging for the collection and processing of sheep and cattle fallen stock.

Fallen stock

Fallen stock is any animal that has died of natural causes or disease on a farm or that has been killed on a farm for reasons other than human consumption.

It is illegal to bury fallen stock on farm. This is due to the risk of spreading disease through residues in the soil, groundwater or air pollution.

This ban also covers animal by-products, including afterbirth and stillborn animals.

Exclusions from scheme

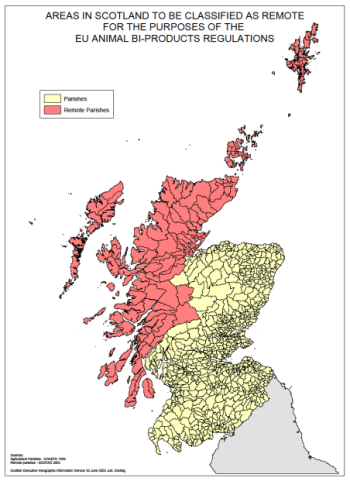

There is a derogation from the ban on burial in some parts of Scotland classed as "remote areas".

This does not mean burial should be regarded as the first option in remote areas, rather it should be the very last option considered for disposal purposes.

A map has been prepared highlighting the areas in Scotland classed as "remote areas" and subject to derogation. Support under the scheme does not extend to on-farm disposal of fallen stock.

Who will administer the scheme?

The scheme will be administered by the National Fallen Stock Company (NFSCo) on behalf of the Scottish Government.

NFSCo will administer the scheme for both members and non-members of NFSCo alike.

What period of time does the scheme cover?

The scheme will cover the period February to April 2018 inclusive.

Who is eligible for support?

All farmers and crofters in Scotland who have made arrangements for the collection and processing of dead cattle and sheep during the eligible time period.

How the scheme will work

NFSCo will calculate the average costs incurred by its members over the February to April period and compare/contrast these costs to the costs incurred over the February to April period this year.

Non NFSCo members will be required to submit evidence in the form of receipted invoices or similar.

The £250,000 support pot will then be distributed on a proportionate basis to those that have incurred additional costs.

Applications from non NFSCo members will require to be submitted by the end of May together with supporting evidence.

Details from non-members require to be submitted on a pro-forma made available by NFSCo.

Payments will commence in June 2018 by BACS.

State aid

The scheme will be operated under State Aid agricultural de minimis arrangements.

Contact

General comments on the scheme should be directed to NFSCo at 01335 320014.