Scottish Suckler Beef Support Scheme (Mainland and Islands) full guidance

This is an old version of the page

This is an old version of the page

Date published: 24 November, 2015

Date superseded: 21 October, 2016

To see recent changes to this guidance, check the bottom of this page.

Table of Contents

- Introduction

- Eligibility

- Claiming subsidy

- Claim period

- Eligibility checks

- Keeping records

- Cattle inspections

- Rules on eartags

- Penalties

- Declarations and undertakings

- Payments

- Our targets

- Information about you and your payments

- Appeals and complaints

- Legal base

- Annex A – non-eligible breeds

- Annex B – single sheet passport example

- Annex C – written list of animals to claim

- Recent changes

- Previous versions

- Download guidance

Introduction

These notes cover the Scottish Suckler Beef Support Scheme (Mainland and Islands Variants). Please read them carefully so you understand the rules of the scheme.

If you have any questions or concerns, please get in touch with your local area office.

Overview of scheme

- this scheme gives direct support to specialist beef producers. It has an annual budget of €38 million for Scottish mainland claims and €6.6 million for claims from the Scottish islands. Payments in sterling will depend on the exchange rate in force at the time

- the scheme year runs from 1 January to 31 December

- we pay on male and female calves at least 75 per cent beef bred

- calves must been born on your Scottish holding and kept there for 30 days

- animals born on or after 2 December are not eligible until the next scheme year. We consider an animal to be one day old on the day after it was born. So an animal born on 2 December is not 30 days old until after 1 January

- claims can be made from 1 September, 2015 and there is no limit to the number of claims you can make by the close of the scheme on 31 December, 2015

- you must keep a herd record book for all cattle on your holding in line with the Cattle Identification Regulations

- we set the payment rate to match the number of eligible animals claimed each scheme year

- we may inspect your holding to check your claims

Registering with Rural Payments and Services

To apply for this scheme, you must be registered with our new system, even if you were previously registered with us.

Eligibility

Producers and agents

Individuals, companies, a partnerships, or a group of these can all claim from this scheme.

You can give an agent authority to act for you and sign your claim form. If you use an agent, you must authorise them to act for you.

You can do this online by creating an account with Rural Payments and Services and logging in.

Alternatively, you can download and complete Form PF05 – Business Mandate You can also get this form from your local area office.

Holdings

Your holding is all the production units (farms or crofts) that you manage. Only production units in Scotland are eligible for this scheme.

Single Application Form

To claim from this scheme you must complete a Single Application Form each year. If you do not do this, your claim will not be valid and we will not make a payment. The main location code you use on your claim form should be the same as the one on your Single Application Form.

Animals

We pay on calves which:

- you own or lease

- are at least 75 per cent beef bred

- are born on your Scottish holding and kept there continuously from birth for at least 30 days

- were born on or after 2 December, 2014

- have a valid cattle passport

- have not been paid under the previous schemes (Scottish Beef Calf Scheme or Scottish Beef Scheme)

Annex A lists breeds that are non-eligible.

Cross Compliance

To be eligible for this scheme you must keep your land in Good Agricultural and Environmental Condition (GAEC) and meet the legal requirements of keeping cattle as part of our Statutory Management Requirements (SMRs).

You can find out more about Cross Compliance below.

Claiming subsidy

Maximum number of claims

There is no limit to the number of claims you can make.

Claiming online

Using our online service is the easiest and quickest way to submit your claim. It helps stop mistakes and reduces the administration costs of the scheme.

Even if you have no access to the internet, you may be able to make use of computers in your local area office.

More information can be found in our customer services section.

Claiming offline

You can still claim by post using:

Scottish Suckler Beef Support Scheme (Mainland and Islands Variants) claim form

You can also get this from your local area office and you should send your completed form back to your area office.

Remember to include your animals' new single sheet passport. Please use the address sheet which accompany the passports when they arrive in the post (see below).

We will only accept and acknowledge your claim form if you or your agent has:

- filled in your Main Location Code, business name and address in section one

- filled in the numbers claimed box and location box(es) in section two

- signed and dated the form in section three. If your claim form has separate pages all must be signed and dated. This may be the case if you print it yourself

- supplied ear-tag numbers (see supporting documents for paper claims below)

Supporting documents for paper claims

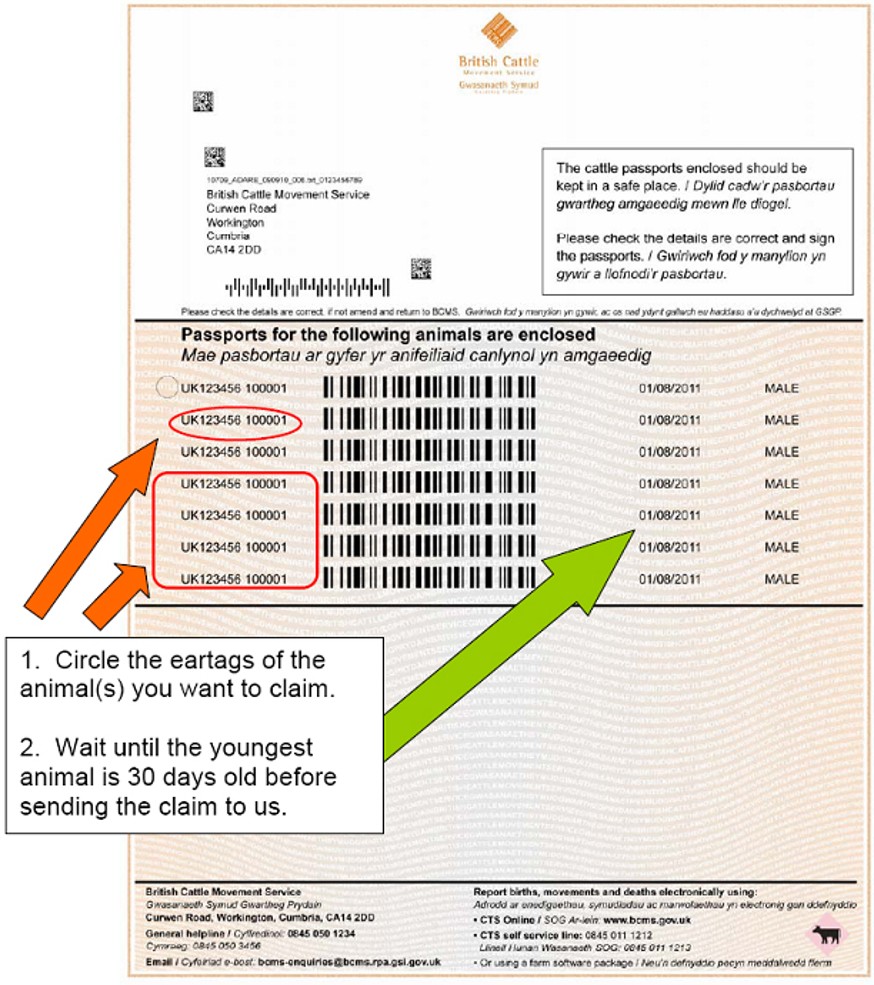

- use the address sheet issued with the new single sheet passports from 1 August, 2011 to claim animals. We are unable to return this document to you. Annex B is an example of how to complete this

- you can provide a list of eartags from a farm management software program. Most programs can produce a list in barcode format which also helps us process your claim quickly and accurately

- if you can’t do any of the above we will accept a written list from you in the format shown in Annex C

The total number of single sheet passports, ear-tag numbers circled on address sheets, or eartags provided on an annex c list, must equal the total number of animals you are claiming for.

Remember to sign, date and write your Main Location Code on any list of ear tags you provide. Attach it securely to the claim form.

Claim period

Claims can be made from 1 September, 2015 and there is no limit to the number of claims you can make by the close of the scheme on 31 December, 2015.

Animals born in the period 2 December, 2014 to 31 August, 2015 can be claimed from 1 September, 2015.

Eligibility checks

We will check all the animals you claim with the Cattle Tracing System (CTS).

To check the CTS records for your animals, either visit CTS Online or use the paper statement sent to you by the British Cattle Movement Service (BCMS).

Keeping records

The Cattle Identification (Scotland) Regulations 2007, as amended, require cattle keepers to keep a herd register of all the animals on each of their County Parish Holding (CPH) locations for 10 years.

This record must be accurate and up to date, or you may lose payments.

Cattle inspections

We will inspect the cattle you claim under the scheme as part of our existing Cattle Identification Inspection programme.

We will check that you have met the scheme’s rules and the Cattle Identification (Scotland) Regulations 2007, as amended.

You must allow us to count and inspect your animals at any reasonable date and time. We may ask you to gather your animals at a convenient place on the holding and you must provide secure handling facilities to allow us to check each animal’s ear tag.

We may not warn you about any inspection we plan to carry out and we may inspect your holding more than once a year.

We will not pay your subsidy and you could face prosecution if you:

- refuse to let us inspect your holding

- prevent our inspector from coming onto your holding

- do not give reasonable help to the inspector

At an inspection we will check:

- all cattle on your holding and compare your herd register against CTS records

- your animals are eligible for the scheme

- supporting documents, such as purchase and sales receipts and slaughter certificates

- CTS have been told about all animals movements

Rules on eartags

You can get details on cattle eartags rules from the BCMS website, by emailing them at bcms-enquiries@bcms.rpa.gsi.gov.uk or by calling their helpline on 0845 050 1234.

Penalties

General

You will lose some or all of your payment if you do not meet the rules of the scheme and the undertakings you give.

You may be prosecuted if you knowingly make a false statement to receive payment for yourself or for someone else.

So it’s important to make sure you understand your responsibilities we would advise you to seek professional advice if you need it.

Scheme penalties

You may face a penalty if you claim for animals that do not meet the rules of the scheme.

If we find a difference between the number of animals you claim in a scheme year and the number of animals that are eligible, we will reduce your payment using a percentage error rate.

To find the percentage error rate, we divide the number of animals found to be not eligible by the number of animals that are eligible – example below. We have five levels of penalties.

- level one – where there are three or fewer penalty animals, we will reduce your payment by the percentage error rate

Penalty levels two, three, four or five apply when the number of non-eligible animals is four or more.

- level two – if the percentage error rate is a maximum of 10 per cent, we will reduce your payment by the percentage error rate

- level three – if the percentage error rate is more than 10 per cent to a maximum of 20 per cent, we will reduce your payment by twice the percentage error rate

- level four – if the percentage error rate is more than 20 per cent, we will not pay you under that year’s scheme

- level five – if the percentage error rate is more than 50 per cent, we will not pay you under that year’s scheme. Additionally, we will also apply a fine to other payments you are entitled to over the following three scheme years. The fine will be equivalent to the payment you would have received had there been no errors in your application

False Declaration

If you knowingly make a false statement in an application, we will apply a fine to other payments you are entitled to over the following three scheme years. The fine will be equivalent to the payment you would have received had there been no errors in your application.

For example:

| If you claim 100 animals but 10 of these are not eligible, the percentage error calculation would be: |

|---|

| 10 (animals not eligible) ÷ 90 (remaining eligible animals) x 100 = 11.1% |

| This is a level three penalty. This means that we pay premium on 90 animals and reduce the payment by 22.2 per cent. |

Cross Compliance penalties

You may face a penalty:

- if you do not keep your land in good agricultural and environmental condition (GAEC) (as set out in annex three of Regulation (EC) 73/2009)

- if you do not keep to the statutory management requirements (SMR) (as set out in annex two of Regulation (EC) 73/2009), which include the Cattle Identification Regulations

Penalties for using banned substances

We may exclude you from the scheme for a year if we find:

- that you have used banned substances (for example, hormones) on your animals or we find these substances on your premises

- we find residues of substances in your animals (for example, medicines) which you have used illegally, or we find these substances stored illegally on your premises

If we exclude you from the scheme for using banned substances and you repeat this offence, we may exclude you for up to five years. If you prevent us from inspecting your holding or taking samples to check for banned substances, we may exclude you from the scheme.

Returning your Single Application Form (SAF) late

If we receive your Single Application after the deadline we will reduce your payment. You can find out more about the Single Application Form and how to complete it online below.

Using our online service is the quickest and easiest way to submit your form each year.

Declarations and undertakings

You must read the declarations and undertakings at section three of your claim form carefully before you sign the form.

Payments

General

We can pay you in sterling or euros. We will pay you in sterling unless you tell us on your Single Application Form to pay you in euros.

We will make payments to your business’ nominated bank account using BACS.

We can only pay into a United Kingdom bank account held in the name of the business. You must provide your business bank account details to allow us to pay you.

Payments by BACS

If we already hold bank account details for your business we will use those.

If you want to change your bank account details, or provide them for the first time, you need to fill in and return the form below.

A paper copy of this form is also available from your local area office. Please keep your BACS details up to date to avoid payment delays.

Payment rates

The payment rate for eligible animals is not fixed. The rate will vary each year depending on the total number of eligible animals claimed in the calendar year. We pay a flat rate for each eligible animal.

- for animals born on mainland Scotland and qualifying for the scheme, we estimate the payment to be around €100

- for animals born on Scottish islands, subject to qualification, the rate will be €160 per animal

For both, payments in sterling will depend on the exchange rate in force at the time but based on the 2014 exchange, these rates are around £78 and £125.

Financial Discipline

If the overall European Union budget for market support measures and direct payments is in danger of being exceeded, there is a mechanism (Financial Discipline) which reduces payments being made across all European Union member states.

This provision is designed to protect European Union taxpayers from budget increases. If we are required to implement the Financial Discipline, we will provide further information with your payment.

Our targets

We can only process your claim if you fill it in correctly and include all the documents we need to support it.

We aim to:

- acknowledge your claim by letter within 14 days

- to pay all eligible claims by 30 June following the end of each scheme year

Information about you and your payments

How we manage your information is set-out in our Privacy Policy, which you can read below.

Appeals and complaints

If you are unhappy with a decision we have made regarding your claim or if you are unhappy with the service we have provided you with, you can make use of our appeals and complaints procedures.

You can find out more about both below.

Legal base

Our legal authority for this scheme is in two parts.

- European Parliament and the Council Regulation 1307/2013 that deals with the basic rules of the scheme

- European Parliament and Council Regulation 1306/2013 that deals with requirements that are more general

Both regulations are supplemented with other regulations. Copies of all these are available on the European Union website.

If you would like to know the full range of regulations, speak to your local area office.

We aim to provide as much guidance as possible on the scheme. But these notes do not provide a full statement of the law, something which only the European Court of Justice can give.

If you have any legal questions, you should get appropriate legal advice from a solicitor.

Annex A – non-eligible breeds

- Armoricaine

- Ayrshire

- Ayrshire Cross

- Black and White Friesian

- Blue Albion

- Blue Albion Cross

- Belted Dutch

- Belted Dutch Cross

- Bretonne Pie-Noire

- British Friesian

- British Friesian Cross

- British Holstein

- British Holstein Cross

- Brown Swiss

- Brown Swiss Cross

- Cross breed Dairy

- Dairy Shorthorn

- Dairy Shorthorn Cross

- Deutsche Schwartzbunte and Swartzbunte Milchrasse

- Estonian Red

- Estonian Red Cross

- Francaise Frisonne Pie Noire

- Fries Holland

- Frisona Espagnola

- Frisona Espagnola Cross

- Frisona Italiana

- Fleckvieh

- Fleckvieh Cross

- Friesian

- Friesian Cross

- Groninger Blaarkop

- Guernsey

- Guernsey Cross

- Holstein Friesian

- Holstein Friesian Cross

- Holstein

- Holstein Cross

- Jersey

- Jersey Cross

- Kerry

- Kerry Cross

- Northern Dairy Shorthorn

- Red and White Friesian

- Reggiana

- Red and White Friesian

- Sortbroget Dansk Maelkerace

- Swiss Gray

- Swedish Red

- Swedish Red Polled

- Swedish Red Cross

- Swedish Red and White

- Water Buffalo

- Yak

- Zwartbonten van Belge / Pie-Noire de Belgique

- or any other dairy breed

Annex B – single sheet passport example

Annex C – written list of animals to claim

Recent changes

| Section | Change | Previous text | New text |

|---|---|---|---|

| Annex A | The list of non-eligible breeds has been updated | - Angler Rotvieh (Angeln) - Rød dansk mælkerace (RMD) - German Red - Lithuanian Red - Ayrshire - Armoricaine - Bretonne pie noire Fries-Hollands (FH), Française frisonne pie noire (FFPN), Friesian-Holstein, Holstein, Black and White Friesian, Red and White Friesian, Frisona española, Frisona Italiana, Zwartbonten van België/pie noire de Belgique, Sortbroget dansk mælkerace (SDM), Deutsche Schwarzbunte, Schwarzbunte Milchrasse (SMR), Czarno-biala, Czerwono-biala, Magyar Holstein-Friz, Dutch Black and White, Estonian Holstein, Estonian Native, Estonian Red, British Friesian, crno-bela, German Red and White, Holstein Black and White, Red Holstein - Groninger Blaarkop - Guernsey - Jersey - Malkeborthorn - Reggiana - Valdostana Nera - Itäsuomenkarja - Länsisuomenkarja - Pohjoissuomenkarja | See Annex A |

Previous versions

Download guidance

Click 'Download this page' to create a printer-friendly version of this guidance that you can save or print out.